ACA Made Simple. Brokers Made Stronger.

This portal is just the start of how Lumelight helps you protect clients, win business, and stand apart. Powered by Lumelight One—built by benefit attorneys, delivered with concierge service, and backed by a full-service compliance team—it’s the edge brokers and advisors count on, and the reason they choose Lumelight.

A Broker's Guide: ACA Compliance for Complex Clients

Client, Sales & Marketing Support.

Enjoy our suite of resources designed to elevate client conversations and enhance your role as a trusted advisor. Simply download, add your logo or company information and start sharing!

Guides

IRS enforcement is now fully automated—meaning even a small ACA filing error can trigger massive penalties. This resource helps you spot red flags early, protect your clients from surprise letters, and reinforce your role as their trusted compliance expert.

Learn how the look-back measurement method lets you average hours over time to determine eligibility and offer coverage on time.

ACA penalties are steep — and many employers still misunderstand the coverage rules that trigger them. This guide gives your clients a clear, plain-language breakdown of what’s required and what’s at stake.

Interns and short-term staff are easy for employers to overlook — but the ACA doesn’t. This guide makes it simple for you to show clients when coverage is required and how to avoid costly mistakes.

Emails

A collection of turn-key email templates to send to your clients & prospects focused on ACA compliance—covering enforcement updates, complex reporting, high-risk industries, and penalty prevention.

Social Media Posts

A collection of ready-to-use social media posts for brokers highlighting ACA compliance, risk prevention, and Lumelight partnership benefits.

Brochures & Sales Material

Share this co-brandable overview of Lumelight One to quickly show clients how you protect them from ACA risk.

Use this customizable deck to guide client or prospect discussions and position yourself as their ACA compliance partner.

Cheat Sheets

ACA reporting isn’t optional — and it can get complicated fast. From figuring out who counts as full-time to choosing the right codes, mistakes can lead to costly IRS penalties. This FAQ highlights what employers need to know to keep Forms 1094/1095 accurate and compliant.

Determining who counts as a full-time employee under the ACA can get messy fast. These FAQs flag potential compliance issues and point you in the right direction without requiring you to dig through pages of regulations.

With affordability set at 9.96% in 2026, employers need to know how safe harbors, opt-out credits, and other plan features impact compliance. This one-page cheat sheet breaks it down.

The ACA affordability percentage and penalty amounts are changing again in 2026 — and the stakes are higher than ever. This cheat sheet gives your clients the latest thresholds in a simple, employer-friendly format.

Reporting ICHRAs on Form 1095-C is full of codes and calculations that trip up employers. This cheat sheet makes it simple — from Line 15 affordability reporting to ZIP code rules.

When employees leave and return, the ACA has strict rules for whether they’re treated as new hires or continuing employees. Get it wrong, and employers risk coverage gaps and penalties. This cheat sheet makes the rules simple with clear examples.

Federal filing doesn’t cover everything. Employers with staff in CA, MA, NJ, RI, or DC face separate state reporting requirements — and missing them can mean penalties. This cheat sheet makes it easy for you to flag risks and keep clients compliant.

Expert Voices. Practical Guidance. Compliance Made Clear.

Our expert-led video library unpacks ACA complexities and shows why white-glove compliance support matters—giving you practical insights to bring into client conversations with confidence.

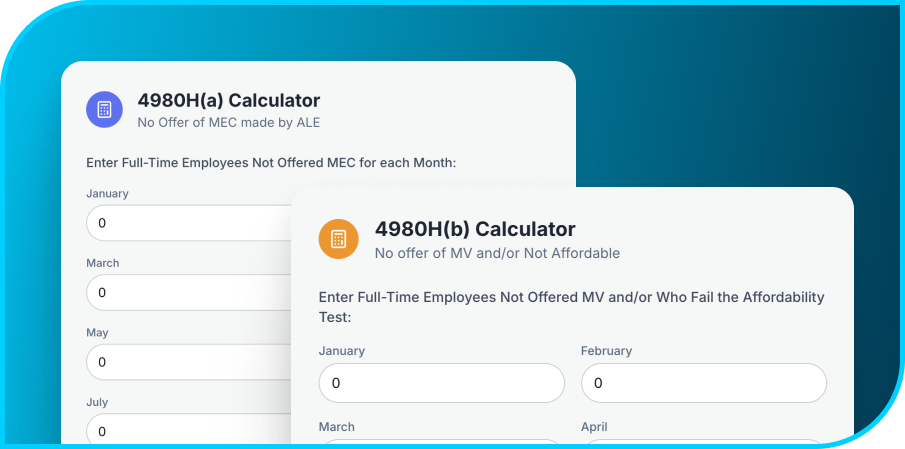

Interactive Penalty Calculator

Go into every client meeting prepared. Our Interactive Penalty Calculator helps you model potential ACA penalties before they happen—so you can walk into prospect or renewal meetings with real numbers, smart questions, and a plan.